In Understanding Gold:Purity,Color,Hallmark we talked about Gold, purity, different colors of gold ex: green gold, pink gold, about hallmarking of gold and why and when Indians buy gold. In this article we shall talk about how a gold ornament is priced. Typically in India gold ornament are made with 22K gold. Price of gold ornaments depends on many factors. The formula or calculation used to arrive at price of gold ornament is given below:

Price of the gold ornament is = Price of 22K gold * ( Weight in Grams + Wastage charges) + ( Making Charges) + VAT

Let’s try to understand Karat, Wastage charges, Making charges, VAT, Price of gold why it fluctuates and how different jewellers charge.

Karat

As we know Gold in its purest form is not suitable for jewelry as it would not be able to withstand the rigors of daily wear and tear. It is therefore alloyed with other metals to make it stronger and more suitable for making jewelry. When this pure Gold is alloyed with other metals, such as silver, copper, or nickel, the Gold percentage decreases. When we say 22kt or 22k Gold Jewellry we mean that 22 parts of the jewellry, is gold and the balance 2 parts are some other metal(s) or equal to 91.3 percent gold plus 8.6 percent of some other metal alloy. The Gold content in a metal is measured in terms of karats (“k” or “kt”). Pure Gold or 100% Gold is referred to as 24k Gold.

Weight in Grams

Gold for Jewellry purposes can be weighed in Grams, Pennyweight (DWT) or Ounces (troy) . In India gold jewellry is weighed in grams.

1 Troy ounce is equal to 31.10348 grams or 20 DWT (pennyweight)

1 Troy ounce is equal to 31.10348 grams or 20 DWT (pennyweight)

More the weight of gold item, heavier the ornament, more the cost.

Making Charges

Making Charges are the charges you pay to the Gold Smith to make the Jewel out of raw gold. A good design is a culmination of artistic view and effort to create a wonderful design that attracts the eyes of buyer. So for making such designs, Jewelery stores generally charges the customer with making charges. This varies from design to design based on the complexity. It varies based on jeweller.

Wastage Charges

During the process of making the ornament some amount of gold will be wasted or will be lost while cutting, soldering,melting etc. Hence the gold gets ‘wasted’ in the manufacture of a jewellery item. These are called wastage charges and jewellery stores generally asks buyer to pay these wastage charges. Generally, the wastage charges are dependent on type of ornament and they range anywhere between 3% to 25%. Wastage charges are expressed as % of weight of gold ornament.

Value Added Tax (VAT)

Several states in India apply a VAT on purchase of Gold in ornament form. Let’s learn little about VAT.

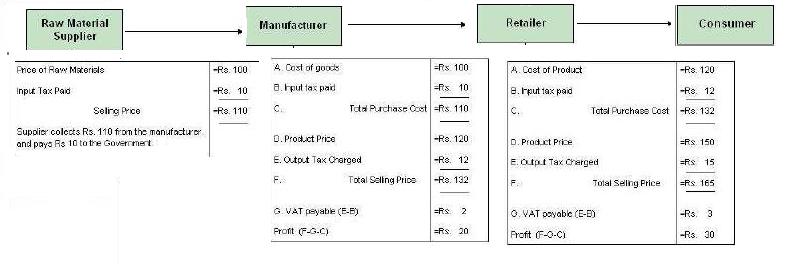

Value Added Tax (VAT) is a type of indirect tax and is one of major source of revenue to the state government. It is multi-point sales tax. It is collected on value addition only at each stage.It differs from the sales tax in that, with the sales tax, the tax is collected and remitted to the government only once, at the point of purchase by the end consumer. With the VAT, collections, remittances to the government, and credits for taxes already paid occur each time a business in the supply chain purchases products. The VAT system of taxation was adopted by Indian States and Union Territories in the Year 2005 by replacing the General Sales Tax Laws. Each state or union territory has its own methods to assess the tax liability and collection methods from the dealers who fall under the purview of VAT. Wikipedia:Value Addition Tax in India explains about VAT. VAT in supply chain purchase process is as shown in picture below.

Price of Gold

Price of gold keeps on changing internationally as well as nationally. All commodities(gold,oil etc) are generally traded in US dollars, hence international prices are important. The supply and demand factor is pivotal in determining the price of gold. There isn’t enough gold being produced to satisfy rising demand. Quoting from livemint:Factors that affect gold prices Demand for gold has been increasing because of :

Governments: International prices of gold are affected by economic affairs. Governments maintain high reserves in the sovereign treasuries to protect against political and economic uncertainty even though gold is no longer used as a currency. For example, if global economic growth is showing an uptrend and financial markets are doing well, demand for gold as an investment (or hedge) will be low as other assets are more in demand

Exchange-traded funds (ETFs):Globally, demand for ETFs has increased. Typically, funds are required to maintain the value of ETFs sold in the form of physical gold, driving up overall demand.

Gold is used as a hedge against movement in the US dollar (acclaimed as the global currency for trade), which means typically gold prices move inversely to change in strength or value of dollar. Traders in this commodity consider this aspect seriously while taking positions in gold.

Indian rupee versus US dollar:All commodities are generally traded in US dollars. India is one the largest consumer of gold, and as supply is not sufficient we import Gold. Given that imported gold is valued in dollars and then later converted to a rupee value for domestic consumption, the rupee-dollar exchange rate is important in determining domestic gold prices. That is why even though international gold prices have corrected in the last two-three months, domestic gold prices have increased.

The day you buy the gold jewellery the price of gold on that day will be charged. Gold rates are published in the newspapers.

Bill

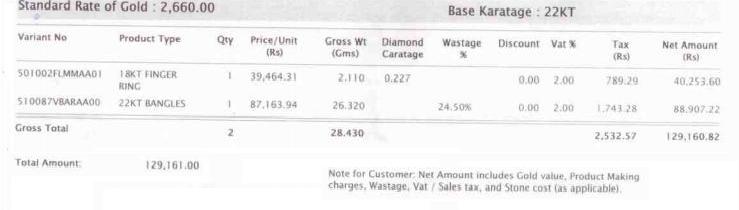

Putting all the things together, when one buys gold ornaments then the cost of gold ornament(without gem or diamond) is calculated as follows:

Cost of the gold ornament based on weight = Price of 22K gold * ( Weight in Grams + (Wastage charges as % of Weight) ) + ( Making Charges )

Total price = Cost of the gold ornament based on weight+ VAT on price of gold based on weight.

For a bracelet of 22K gold of weight 26.320 bought when gold was Rs 2,660 and wastage 24.50% , cost of bracelet works out to be

Wastage = 24.50% of Weight of bangles = 24.50 % of 26.320 = 6.4484 gm

Total weight of bangles = Weight of bangle + wastage = 26.320 + 6.4484 = 32.7684 gm

Cost of bangles based on weight = 2660 * 32.7684 = 87163.94

Making charge = 0

VAT = 2% of cost of bangles = 2% of 87,163.94 = 1743.28

Total cost = Cost of bangles based on weight + VAT = 87163.94 + 1743.28 = 88,907.22

A bill for a bracelet and finger ring bought in Mar 2012 is shown below. Thanks to my friend Nandini and Poonam for sharing their jewellery purchases bill with us. Note that diamond ornament price calculation is different.

Jewelers run offers like zero making charges etc You can negotiate with the store you are buying to reduce the making charges .Premkumar Masilamani bargained at the jeweller’s shop and saved Rs 3,816 by talking to the manager, you can read his experience here.

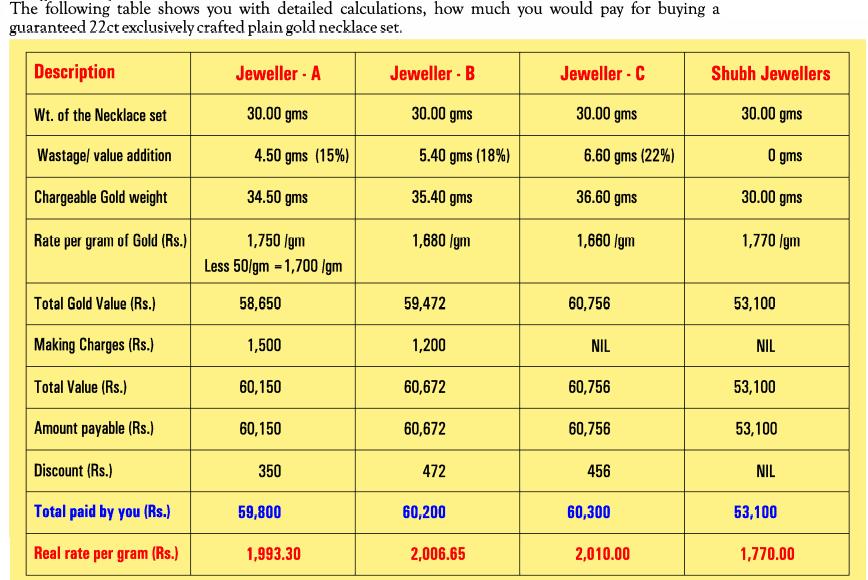

Different Jewellers Different Cost

Different jewellers will charge different amounts for similar ornament, mostly due to different wastage and making charge . The following advertisement by Shubh Jewellers shown below brings out the fact.

Bangalore Metro Reporter did an article on TAKING PEOPLE FOR A GOLDEN RIDE…. SHUBH JEWELLERS- Pay for 24 carat get 22 carat Gold. The Shubh Jewellers, a retail chain of jewellery stores promoted by the Rajesh Exports proclaimed that people will be save lot of money if they purchased gold items from Shubh stores as they are selling the gold items at real rate per gram and they will not charge for wastage, making and stones. The above picture comparing the various jewellers were part of the advertisment of Shubh Jewellers. But the report claimed that they are selling the 22 carat gold at the rate of 24 carat. As their gold price is more they do away with wastage and making charge. As one of my friend Nimmi says, When you are spending so much money it is better to buy from a reputed jeweller like Tanishq atleast your gold is pure though you pay higher. While my other friends buy gold from their home town their family jeweller.

Exchanging Gold Jewellery

Branded jewellery comes with hallmark certification and has a higher resale value than non-branded jewellery. However Most traditional jewellery does not come with any documented quality assurance. Most of the jewellers would accept the jewels from their own shop and charge melting/usage charge. If ornament is from other jewellers then they do a purity test and would charge according to the weight. As Premkumar Masilamani found out that the Golden Ring that his dad purchased from his regular jeweller shop in Chennai many years ago, with the printed word “916 KDM” failed in the purity test. It had only 80% gold and the rest was mixed with Silver.